China’s slowdown is a key risk for the world economy, commodities and energy markets as well as the semiconductor industry. — Bloomberg

China’s slowdown is a key risk for the world economy, commodities and energy markets as well as the semiconductor industry. — BloombergA slowing China economy is a bane for the world economy. While the global economy continues to gradually recover in 2023, the growth remains weak and low by historical standards, and the balance of risk remains tilted to the downside. It is not out of the woods yet.

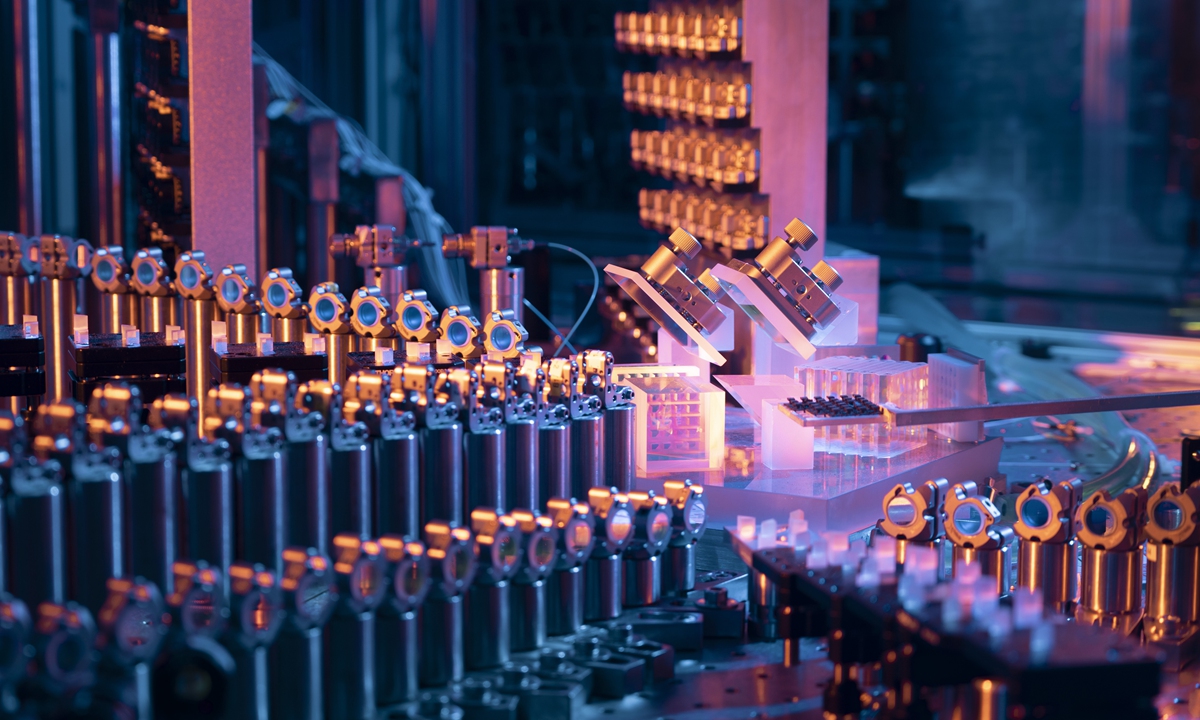

Global manufacturing and services activities are losing momentum. Global trade, especially exports, remain in the doldrums, weighed down by weak consumer and business spending amid a continued inventory adjustment in the semiconductor sector.

Prices of commodities and energy have also softened. Global monetary tightening has started to weigh down on activity, credit demand, households and firms’ financial burden, putting pressure on the real estate market.

A slew of disappointing economic data for two consecutive months (June and July) from China indicated that the world’s second-largest economy (17.8% of the world’s gross domestic product or GDP) is indeed losing steam.

Falling exports, weak consumer spending, slowing growth in fixed investment and continued concerns about the property sector have dampened the recovery.

The emergence of deflation concerns adds to the complexity of China’s flagging recovery.

The Chinese government has provided a range of strategic measures aimed at targeting specific sectors.

These range from consumption (spending on new energy vehicles, home appliances, electronics, catering and tourism) to the property sector (reducing down-payment ratios for first-time homebuyers, lowering mortgage rates and easing purchase restrictions for buying a second house) and tax relief measures to support small businesses, tech startups and rural households.

China’s slowdown is a key risk for the world economy, commodities and energy markets as well as the semiconductor industry.

Prior to the Covid-19 pandemic, China was the world’s most important source of international travellers, accounting for 20% of total spending in international tourism (US$255bil overseas and making 166 million overseas trips in 2019).

We consider three channels through which China’s slowdown can have spillover effects on Malaysia via direct and indirect transmissions: trade and commodity prices, services and financial markets.

Overall, the estimated impact of a 1% decline in China’s GDP growth could impact about 0.5% points on Malaysia’s economic growth.

Trade is the most important channel as China has been Malaysia’s largest trading partner since 2009, with a total trade share of 16.8% (exports share: 13.1%; imports share: 21.2%) in the first half of 2023 (1H23).

Spillovers from slower China demand and commodity prices are negative for Malaysia, a net commodity exporter.

After recording seven successive years of increases in exports to China since 2017, Malaysia’s exports to China declined by 8.8% in 1H23.

In sectors such as tourism, China’s tourists are one of the major foreign tourists in Malaysia. In the first five months of 2023, Chinese tourists totalled 403,121 persons or 5.4% of total international tourists in Malaysia, and was only 12.9% of 3.1 million persons in 2019.

According to the Malaysia Inbound Tourism Association, though the number of Chinese tour groups coming to Malaysia has increased in July and August to between 800 and 1,000 for the summer vacation, the number of tourists per group is smaller between 10 and 20 persons.

While direct financial links between China and Malaysia are limited, there will be indirect spillovers through spikes in global financial volatility as investors worry that China’s deep economic slowdown would temper global growth, and also has spillovers to the US economy.

Will China foreign direct investment (FDI) inflows into Malaysia slow?

Capital movements will be influenced by the inter-linking of factors such as economic growth and investment prospects in the host country (Malaysia).

These include stable political conditions and good economic and financial management as well as conducive investment policies.

The US-China trade war and rising trends of geoeconomic fragmentation have witnessed FDI flows among geopolitically aligned economies that are closer geographically as well as geopolitical preferences.

Throughout the period 2015-2022, China’s gross FDI inflows into Malaysia averaged RM7.5bil per year. Even during the Covid-19 pandemic, China’s economic slowdown did not deter the inflows of FDI into Malaysia (RM7.8bil in 2020; RM8.1bil in 2021; and RM9.8bil in 2022).

In 1H23, China’s gross FDI inflows increased by 25.2% to RM2.1bil though it is likely that the full-year FDI will be below the average FDI inflows of RM8.6bil per year in 2020 to 2022.

China was the largest foreign investor in Malaysia’s manufacturing sector in 2016 to 2022 before dropping to second position in 2022 and the fourth position in 2021.

There was a contrasting picture when it comes to China’s approved investment in the manufacturing sector, which saw two consecutive years of decline (2022: 42.5% to RM9.6bil and 2021: 6.5% to RM16.6bil) and declining further by 17.8% to RM4.3bil in the first quarter of 2023.

We believe that Malaysia will remain one of the preferred investment destinations to China, given both countries’ strong established friendship and bilateral ties in trade and investment as well as people-to-people movements.

Malaysia needs to enhance its investment climate with progressive policies to rival regional peers to offer the country as a China Plus One destination for China and foreign companies.

Malaysia can offer investments to build a chip-testing and packaging factory, advanced manufacturing technologies such as robotics and automation, manufacturing electric vehicle supply chain, petrochemicals, renewable energy, agriculture and food processing.

China can offer the technology, innovation and technical know-how as well as talent that deepen the country’s industry integration with global supply chains and also links Malaysia and China to South-East Asia.

China can invest in Malaysian manufacturing companies to help them adopt advanced manufacturing technologies and further improve their competitiveness.

The RM170bil prospective investments (comprising RM69.7bil from 19 memoranda of understanding and RM100.3bil from the round-table meeting) concluded during the prime minister’s visit to China are set to provide a massive investment boost to our economy for years to come.

Among these are China’s Rongsheng Petrochemical Holdings, which will invest RM80bil to build a petrochemical park in Pengerang, Johor; and investment from Geely, with an initial investment of RM2bil in the Tanjung Malim Automotive Valley, which will gradually increase to RM23bil in the future.

LEE HENG GUIE is Socio-Economic Research Centre executive director. The views expressed here are the writer’s own.

Related posts:

Recession unlikely for global economy but challenges linger on

China's Rise to Economic Superpower, economy stands out in global arena

Don't worry about China slowdown !

Decoding China's secret recipe of success for an economic miracle

Related:

China's official manufacturing purchasing managers' index (PMI) continued to improve in August, marking the third consecutive monthly increase despite the index remaining in contraction territory.

China is set to further increase financial support for private enterprises by introducing measures to lift the proportion of loans to private enterprises, according to the People's Bank of China (PBC), the country's central bank.

US investment restrictions on key technology sectors in China will undermine industries that are highly dependent on the global division of labor and a free and fair international economic order, China's trade promotion agency said on Wednesday

US Commerce Secretary Gina Raimondo was wrapping up her "successful and productive" four-day high-stakes visit to China on Wednesday, with the visit yielding material results, including the establishment of new communication channels to seek solutions to specific busine

China's economy isn't as bad as the prevailing mood suggests and growth is moving in the right direction as consumer spending picks up, said Chris Torrens, vice chairman of the Britis

Entrepreneurs and industry experts exchange ideas at the Summer Davos Forum in Tianjin. Photo/Xinhu

Entrepreneurs and industry experts exchange ideas at the Summer Davos Forum in Tianjin. Photo/Xinhu