|

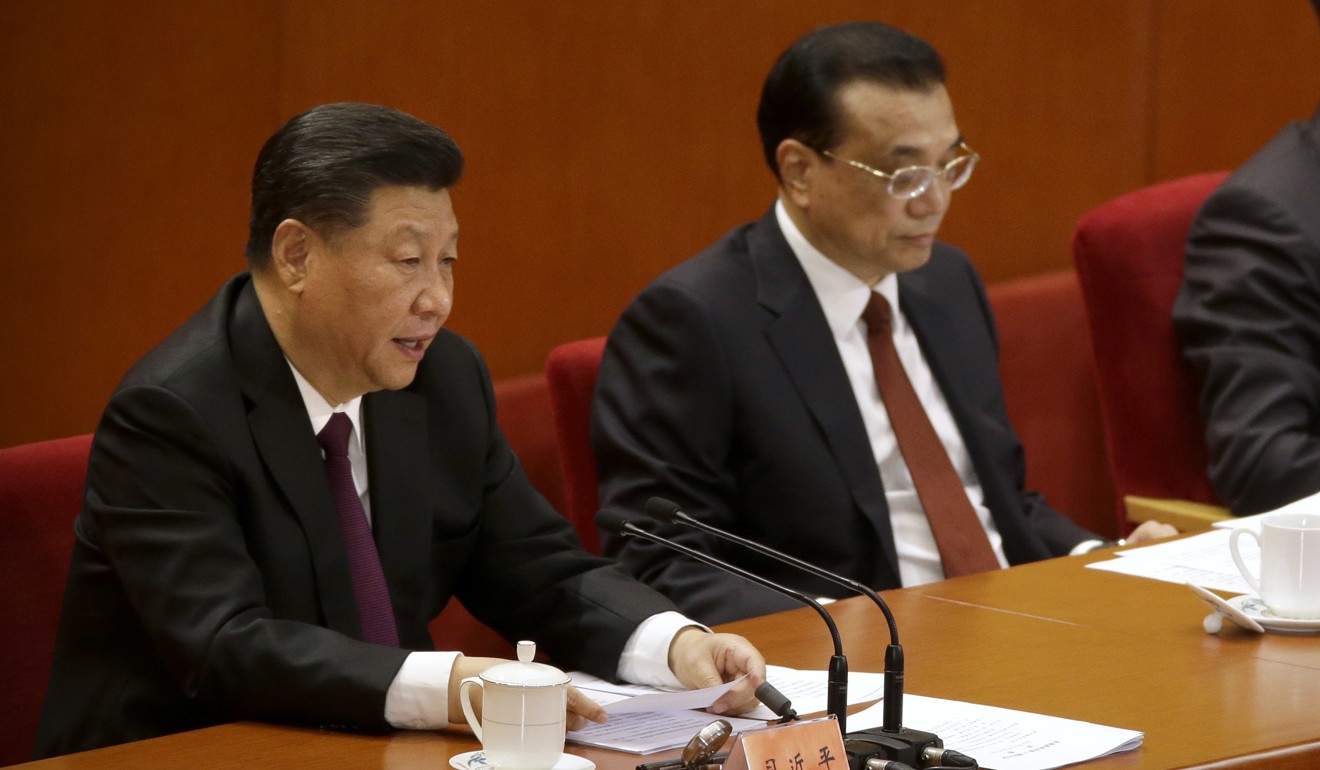

| Chinese President Xi Jinping ahead of his speech at the Great Hall of the People in Beijing to mark the 40th anniversary of China's reform and opening up. Photo: Reuters |

https://youtu.be/MILBtNHX4rQ

China faces “unimaginable” perils and dangers ahead and must rely on Communist Party rule and economic reform to sail through them, Chinese President Xi Jinping said in one of the most watched speeches of his leadership in Beijing on Tuesday.

Speaking at the Great Hall of the People to mark the 40th anniversary of the country’s reform and opening up, Xi did not directly address the specific challenges facing the world’s second biggest economy or touch on sensitive issues such as the ongoing trade war with the US.

Instead, Xi spent much of the hour-and-a-half speech drawing general conclusions about China’s economic and social development in the past four decades since Deng Xiaoping, China’s former paramount leader, started to embrace market-oriented changes in China.

The No 1 lesson China can draw from the 40 years of success is that the country must stick to the leadership of the Communist Party, Xi said.

“The practices of reform and opening up in the past 40 years have shown us that the Chinese Communist Party leadership is the fundamental character of socialism with Chinese characteristics … east, west, south, north, and the middle, the party leads everything,” he said.

“Every step in reform and opening up will not be easy, and we will face all kinds of risks and challenges in the future and we may even encounter unimaginable terrifying tidal waves and horrifying storms,” Xi said.

- Chinese president avoids specifics for the road ahead

- Audiences at home and abroad need convincing that reforms started 40 years ago will continue

China faces “unimaginable” perils and dangers ahead and must rely on Communist Party rule and economic reform to sail through them, Chinese President Xi Jinping said in one of the most watched speeches of his leadership in Beijing on Tuesday.

Speaking at the Great Hall of the People to mark the 40th anniversary of the country’s reform and opening up, Xi did not directly address the specific challenges facing the world’s second biggest economy or touch on sensitive issues such as the ongoing trade war with the US.

Instead, Xi spent much of the hour-and-a-half speech drawing general conclusions about China’s economic and social development in the past four decades since Deng Xiaoping, China’s former paramount leader, started to embrace market-oriented changes in China.

The No 1 lesson China can draw from the 40 years of success is that the country must stick to the leadership of the Communist Party, Xi said.

China tightens control of local economic data ahead of expected weak growth next year

.“The practices of reform and opening up in the past 40 years have shown us that the Chinese Communist Party leadership is the fundamental character of socialism with Chinese characteristics … east, west, south, north, and the middle, the party leads everything,” he said.

“Every step in reform and opening up will not be easy, and we will face all kinds of risks and challenges in the future and we may even encounter unimaginable terrifying tidal waves and horrifying storms,” Xi said.

“Only by improving the party's leadership and governance … can we ensure the ship of reform and opening up will sail forward.”

Xi’s

speech was delivered as prospects for China’s growth are clouded

abroad, by rising rivalries between China and the US, and by a deepening

economic slowdown at home.

Xi,

who is now legally entitled to retain his presidency beyond 2023 after a

constitutional amendment in March this year, needs to convince domestic

and foreign audiences that Beijing remains committed to the economic

liberalisation process that was started by Deng 40 years ago.

The

stock indexes of Shanghai and Shenzhen, which had both risen in early

trading in anticipation of possible policy announcements, retraced their

declines soon after proceedings began.

Shanghai’s

composite index fell as much as 1.2 per cent, while Shenzhen’s index

fell as much as 1.5 per cent to an eight-week low.

On the Hong Kong exchange, the Hang Seng Index fell 0.9 per cent while the H-share index declined 1.3 per cent.

Xi stressed that China would stick to its own chosen path, namely socialism with Chinese characteristics.

“To

push forward reform and opening up in a country with 5,000 years of

civilisation and a population of 1.3 billion, there are no textbooks

containing golden rules or teachers who can be arrogant to the Chinese

people,” he said.

Xi

quoted the renowned Chinese author Lu Xun, who asked, “what's a road? A

trodden path in a place where there was previously no road, and a

passage opened from a place where there were only thorns.”

Xi

opened his speech by saying the Cultural Revolution, from 1966 to 1976,

had brought China's economy to the brink of collapse and went on to

quote Deng, saying “China's modernisation and socialism will be buried

if we do not embrace reform and opening up now.”

The

audience at the Great Hall of the People listen to Chinese President Xi

Jinping’s speech commemorating 40 years of opening up and reform.

Photo: Xinhua

He

made it clear that Beijing would not abandon its road as China's

developmental achievements in the past four decades had proven the

“vivid vitality” of China's “scientific socialism”.

“For

those that ought to be changed or can be changed, we will change; but

for those that shouldn't be changed or cannot be changed, we will firmly

not change,” Xi said.

In

international relations, Xi reiterated Beijing’s existing line that

China would not seek hegemony, but he did not mention the US

specifically.

Xi

said China was walking closer to the world’s centre stage and was now

“an internationally recognised” builder of world peace, a contributor to

global development, and a keeper of international order.

China, he said, had contributed “China wisdom, China solutions and China power” to world peace and development.

The

Chinese president said China would play its role as “a big responsible

country” to support developing countries and to take part in global

governance.

“China

will never grow at the cost of other countries' interests but will

never give up its legitimate rights and interests … China's development

does not pose a threat to any other country. No matter how far China

develops, it will never seek hegemony,” Xi said.

In

a long list of China's economic and social achievements of the past

four decades, Xi said China had achieved an annual average growth in GDP

of 9.5 per cent since 1978, and contributed more than 30 per cent

towards total global economic growth for many years.

China,

he said, was now the world's second largest economy, the world's

biggest manufacturing country and the world's No 1 commodity trading

country.

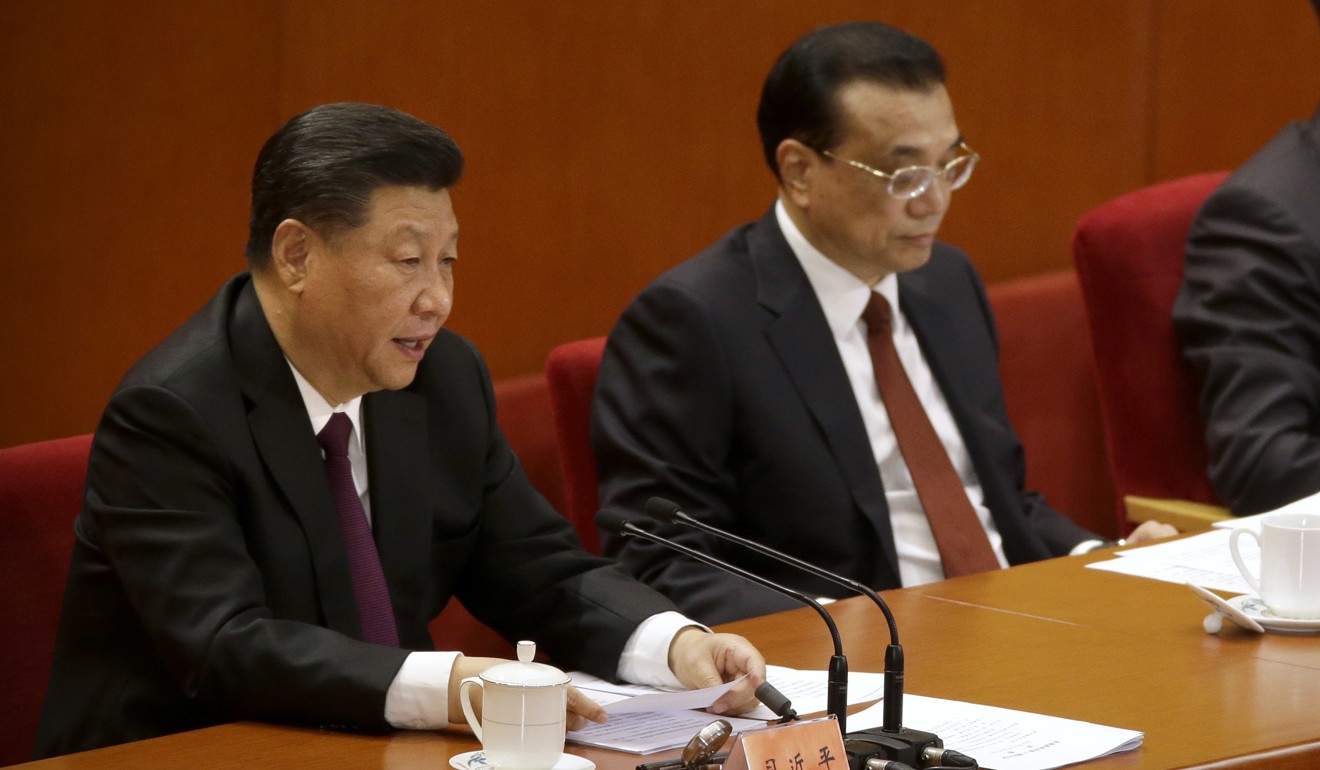

From

left: Chinese President Xi Jinping and Premier Li Keqiang at the 40th

anniversary commemorations of reform on Thursday. Photo: AP

In

terms of ideology, Xi said China would stick to its official ideology,

namely Marxism, Leninism, Mao Thought, Deng Xiaoping Theory, Three

Represents theory, scientific development concept and his own “Theory of

Socialism with Chinese Characteristics in the New Era”.

In

terms of economic policies, Xi reiterated the policy that China would

support public ownership while offering “unswerving” support to

non-state sectors.

:brightness(10):contrast(5):no_upscale()/dollar-collapse-56a9a7aa3df78cf772a9418b.jpg)