These lifestyle changes will definitely not be easy but they could help stretch the ringgit and leave some extra cash in the wallet in these tough times.

Pages

Rightways - Sowing the seeds of Succes

Share This

Wednesday 29 June 2022

Food for thought on footing the bill

A lack of this important mineral could be causing you health problems without you even knowing it.

NATO’s expansion stumbles as members calculate costs

Europe will certainly not become more secure after this round of NATO expansion

There is a lack of mutual understanding and compromise in European culture, where countries are focused on maximizing their own security interests without regard for others. The US is certainly glad to see Europe in this state.

Editor's Note:

NATO, which is constantly looking for imaginary enemies and justifying its existence by inciting confrontation, is holding a summit from Tuesday to Thursday, and it also plans to extend its tentacles to the Asia-Pacific region. Behind its aggressive narrative, contradictions and divisions within NATO have become increasingly prominent. The Russia-Ukraine conflict is not going according to NATO's playbook. This series of articles will provide some clues regarding NATO's predicament. This is the fifth piece. NATO, the North Atlantic Treaty Organization, was established in 1949, but to this day it remains an important tool for suppressing the opponents of the West. The initiative to unite 12 countries originally belonged to the United States, which became the most powerful world leader after the end of World War II. The US was the foundation of the organization's military power, a source of economic and financial assistance to member countries. It goes without saying that not only the highest command posts belonged to the Americans, but they also defined strategic objectives at all stages of NATO's activities. The main mission of this organization from the very beginning was the unification of military and economic resources under the command of the US to prepare an all-out war against the Soviet Union. The countries of another military bloc, the Warsaw Pact Organization (ATS), led by the USSR, also became enemies. It was created only six years after NATO - in 1955. NATO played an important role in weakening the USSR and its allies. After the collapse of the Soviet Union and the dissolution of the Warsaw Pact in 1991, the question arose about the feasibility of continuing the existence of NATO. But the US, which really ruled the bloc, set a new task for it - to involve former ATS member countries and post-Soviet republics in its structure. This was considered necessary to expand the zone of America's strict control over Europe as the most important part of the world at that time. NATO was also used to "sweep" the European space during the war against Yugoslavia. NATO and its de facto twin in the field of economics and politics - the European Union - were used in organizing the "color revolution" in Kiev and provoking the current Ukrainian crisis. In these situations, the US uses NATO as a tool for dirty work, saving the US from the loss of "precious American lives" and the risk of retaliatory strikes on the territory of the US. NATO's successful fulfillment of its tasks in Europe led Washington to think about using the potential and experience of the bloc in another part of the world. Having recently identified China as the most serious threat to the international order, Washington is faced with a lack of resources to contain and suppress the growing Chinese power. In order to mobilize the existing resources, the Biden administration has developed a concept of Indo-Pacific security, strongly resembling a similar concept for the North Atlantic. The concept has already been reinforced by the creation of the Indo-Pacific Command of the US Armed Forces. Already available resources were activated - military alliances with Japan, South Korea and Australia. The AUKUS military group was created. The activity of the QUAD military-diplomatic group is stimulated. The creation of the Indo-Pacific Economic Framework was recently announced. But even these actions are not enough for Washington. Therefore, it is urgently necessary to extend the scope of NATO's responsibility to the Indo-Pacific region as well. Obviously, US efforts are aimed at uniting all Asian and European allies, their military, economic and geostrategic resources to create a new tool for the realization of American global ambitions. It can be conditionally called the Indo-Pacific Treaty Organization according to the patterns of NATO. Of course, the arrival of NATO to the East, especially since the new military bloc of the West, will threaten the security interests of Russia as a Pacific power. But first of all, it will be directed against China. Strengthening the militarization of the region will also contradict the interests of economic stability and security of ASEAN, APEC and other groupings of the region. Serious obstacles may arise in the way of implementing Biden's chess game. We are not talking about the fluctuations of European satellites in NATO such as "ready for anything" Poland, the "Baltic troika" or the Balkan neoplasms. It is unlikely that we will talk about England with its age-old anti-Chinese traditions and loyalty to Washington at the level of a conditioned reflex. But such large "stakeholders" as Germany, France, Spain and Italy may think hard about the consequences of entering into a military confrontation with China, taking into account their trade and economic interests. These powers are well aware of the benefits of bilateral trade with China, which amount to tens and hundreds of billions of euros. They are also aware of the intention of the White House to lift trade sanctions against China in an attempt to bring down the threatening increase in inflation. The role of trade and economic "cannon fodder" is unlikely to entice figures claiming some level of independence even within the framework of NATO. In Madrid, the leaders of significant European powers are unlikely to voice their doubts, but then they will try to "put on the brakes" in implementation of Biden's Indo-Pacific plan. Another important reason for avoiding the dubious honor of becoming a member of the anti-Chinese coalition may be Washington's inconsistency. Just two years ago, then US president Donald Trump reproached NATO member countries for the insufficiency of military efforts, the desire to "ride for free" and even promised to dissolve the military bloc. What will happen after the next presidential election? Will Trump come back? Won't those business and political circles that oppose the dispersion of the waning power of their power, for the concentration of resources on solving domestic economic and humanitarian problems, win? Europeans are already suffering losses from following Biden's anti-China course. The ratification of the China-Europe Comprehensive Investment Agreement has been disrupted. Taking into account the hostile policy of Poland and the Baltic countries, Chinese logistics companies are reviewing the routes of goods delivery to Europe via the Silk Road. Beijing is studying the experience of "crippling sanctions" against Russia. After all, Washington has threatened to impose similar sanctions not only in case of the aggravation of the situation around the Taiwan island, but even if China refuses to participate in sanctions against Russia. The US' convulsive attempts to return itself to the role of world hegemon are unlikely to succeed. But they can cause considerable harm to mutually beneficial relations between countries, which will be difficult to compensate quickly.The author is head of the "Russian Dream-Chinese Dream" analytic center of the Izborsk Club. opinion@globaltimes.com.cn

The sewage of the Cold War cannot be allowed to flow into the Pacific Ocean.

NATO to set stage for extending into Asia-Pacific, faces internal difference

On the heel of the G7 summit, NATO leaders are scheduled to convene in Spain from Tuesday to Thursday for their annual summit with the main focus on Russia and toughening up its stance toward China, while analysts said including China in the US-led military bloc's new strategic concept cannot help alleviate US divergences with the EU, especially on China, and severe domestic problems will also weaken Washington's ambitious plan to maintain hegemony.

This is also a shock to the Swedish and Scandinavian population, because they think that NATO is supposed ...

“NATO skeptics” in the US are exerting more pressure on the transatlantic relationship and weakening US leadership in ...

NATO’s failure does not only stay on the battlefield – it seems an entire US post-Cold War strategy ...

NATO is increasingly trapped in a predicament that it may feel difficult to escape.

Related posts:

G7 to raise US$600bil PGII to counter China’s initiative met with skepticism, mockery

Beyond the submarine feud, contains China's rise

Asean nations caught in a quandary over AUKUS Pact

Cold War schemer: Reminiscing in its past ‘victory,’ US brings color revolutions to 21st century to maintain its hegemony

That sinking feeling from Down Under: Australia, United Kingdom and United States (Aukus) pact

AUKUS plans to provide nuclear submarines to Australia seriously endangers nuclear non-proliferation

Thursday 23 June 2022

BRICS summit kicks off, calls grow for parallel payment system to counter US hegemony

How does BRICS continually play its role in the world?

It's been 16 years since the foundation of the BRICS mechanism was laid. China hopes to work with all BRICS countries to respond to the major concerns of the international community and build a more comprehensive, closer, more practical and inclusive partnership. Even more, China hopes to keep its promises to the 2030 Agenda for Sustainable Development Goals.Against current risks and challenges, the participants also pledged to ensure that the customs authorities of BRICS countries continue to work together to safeguard the international supply chain and promote rapid economic and trade recovery among BRICS countries. In this upcoming episode of "The Chat Room", we talk about how does BRICS continually play its role in the world. Also, focusing on the member states' achievements and challenges under BRICS, we invite five guests from BRICS countries to share their opinions. How does Sino-Indian cooperation play its role in the world? What's the current economic situation of BRICS? What roles has BRICS found itself in the world? How should we see BRICS+ in the future? #BRICS2022

China's Xi Slams Sanctions for 'Weaponizing' World Economy at BRICS

BRICS-led New Development Bank approaches 7th anniversary

China will host the 14th BRICS Summit on June 23 and Chinese President Xi Jinping will join with the leaders of Brazil, India, Russia and South Africa via video link to discuss issues of mutual concern as part of the summit themed around ushering in a new era for global development. The New Development Bank, established in 2015 by the BRICS countries, will soon celebrate its 7th anniversary. Tian Wei talks to the bank's Brazilian president Marcos Troyjo about his visions for the multilateral institution.#BRICS2022

Aerial photo taken on June 17, 2022 shows the headquarters building of the New Development Bank (NDB), also known as the BRICS bank, in east China's Shanghai.(Photo: Xinhua)

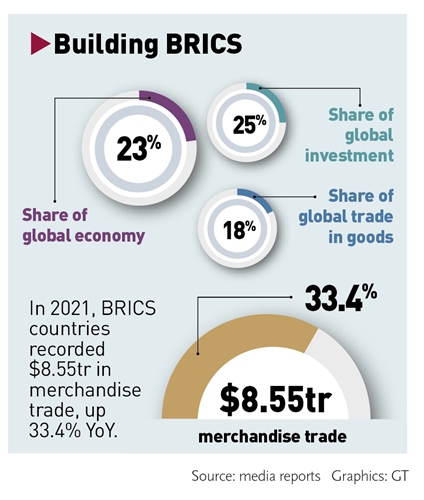

In a keynote speech at the opening ceremony of the BRICS Business Forum on Wednesday, Chinese President Xi Jinping called on the BRICS business community to expand cooperation on cross-border e-commerce, logistics and local currencies. As the 14th summit of the BRICS, a group of major emerging market economies comprising Brazil, Russia, India, China and South Africa, kicked off on Wednesday, there are growing calls from bankers and economists in BRICS countries, especially Russia, for the bloc to expand national currency settlements and lending to counter the US' weaponization of the dollar. Russian President Vladimir Putin said in a welcome address to BRICS Business Forum participants on Wednesday that the issue of creating an international reserve currency based on a basket of currencies is under review, Russian news agency TASS reported. "The BRICS and other interested nations need to talk about setting up their own independent global financial system - whether it would be based on the Chinese currency or they will agree on something different. They need to debate this," Sergey Storchak, chief banker of Russian bank VEB.RF, told the Global Times in a video interview on Tuesday. Storchak said that he hopes during China's presidency of this year's BRICS summit, member countries have open discussions on what really needs to be done. VEB.RF is a major financial development institution in Russia that has been excluded from the SWIFT system. There has been an ongoing discussion within the BRICS to accelerate payments in national currencies for years, and the need is becoming particularly urgent after the US removed some Russian banks from the SWIFT global interbank payments system and forced other economies to pay for its economic problems with sizeable financial tightening. "If the voices of emerging markets are not being heard in the coming years, we need to think very seriously about setting up a parallel regional system, or maybe a global system," he said.

The impact of being pushed out of the SWIFT system is quite large, Storchak said. "The biggest issue is the transfer of money and information, and we need to come to the issue of the wide utilization of national currencies. It would mean that we would not need to use the banking system of either the US or the EU," he said.

Such calls for an independent payment system are growing within the BRICS.

Marco Fernandes, a Brazil researcher at the Tricontinental Institute for Social Research, also called on the BRICS to focus on creating an alternative to the US dollar's hegemony in global transactions at a conference at the Chongyang Institute for Financial Studies of the Renmin University of China on Tuesday.

"After confiscating tens of billions of dollars in reserves and assets from countries like Iran, Venezuela and Afghanistan, the seizure by the US and the EU of more than $300 billion of Russia's reserves, triggered a global alert, reaffirming the urgency of alternatives to the dollar's dominance," Fernandes said. Analysts noted that the US' increasing use of the dollar as a political weapon in recent years - through sanctions or conditional loans - prompts countries to seek other currencies for commercial transactions and in the composition of their foreign reserves. To shrug off pressure from the US to join in its sanctions against Russia, India was exploring the possibility of using the Chinese yuan as a reference currency in an India-Russia payment settlement mechanism for its oil trade with Russia, Indian news outlet Livemint reported in May. In addition, former Kremlin economic adviser Sergey Glazyev has proposed a new global financial system - via an association between the Eurasian Economic Union and China - that would be underpinned by digital currency and backed by a basket of new foreign currencies and natural resources of the member countries, according to website The Cradle, which mainly covers West Asian geopolitics. Cao Heping, an economist at Peking University, said that there are other bilateral or multilateral global settlement systems for cross-border financial services, including China's Cross-border Interbank Payment System (CIPS). The CIPS processed around 80 trillion yuan ($11.91 trillion) in 2021, up more than 75 percent year-on-year. According to data from SWIFT, the yuan retained its position as the fifth most active currency for global payments by value in April, with a share of 2.14 percent. Cao suggested that BRICS members step up cooperation in investment and financing in major sectors such as strategic emerging industries and digital innovation in a bid to boost the use of local currencies in trade and investment settlement. BRICS countries are an important driving force for regional and global economic and trade growth. Despite the prolonged impact of COVID-19, the total volume of trade in goods of BRICS countries reached nearly $8.55 trillion in 2021, up 33.4 percent year-on-year, official data showed. The bloc accounts for 18 percent of trade in goods and 25 percent of foreign investment globally, statistics show."Along with the development of the mobile internet, digital payment has also become a tool for cross-border transactions. More opportunities are expected in this regard," Cao said.

Xi offers answers to questions of the times at BRICS forum

Chinese President Xi Jinping on Wednesday offered his answers to the questions of the times at a keynote speech in ...

Trade between China and BRICS countries stood at 1.31 trillion yuan ($196 billion) from January to May, surging ...

With the 14th BRICS Summit to be held on Thursday, business representatives from the bloc of emerging markets ...

No matter how big the obstacles and crises are, the BRICS countries will not stop striving to establish ..

Covid-19 patients can get antiviral drug Paxlovid for Free

More than 1,300 patients have recovered from Covid-19 with no side effects after taking Paxlovid, says health minister Khairy Jamaluddin. (Reuters pic)

PETALING JAYA: The antiviral drug Paxlovid will be available for free to Covid-19 patients at private health facilities, says the Health Minister.

Khairy Jamaluddin said the drug has been available at these facilities since Monday, and his ministry had distributed the circulars and guidelines on the expansion and use of the drug to private healthcare on June 16. ALSO READ: Covid-19: Over 1,300 patients recovered after Paxlovid treatment, says KJ “The provision of the drug to patients at private health facilities is free. However, patients are still subject to consultation charges and other related charges determined by the private health facility,” he added. Paxlovid is the first oral antiviral drug available in Malaysia that treats Covid-19 patients with mild to moderate symptoms or Categories 2 and 3. Khairy said priority would be given to the high-risk group of Covid-19 patients. ALSO READ: Covid-19: Over 1,300 patients recovered after Paxlovid treatment, says KJ The use of the antiviral drug started in health facilities under the ministry on April 15. Meanwhile, Khairy also said 107,844 individuals aged 12 and above had received their second Covid-19 booster jab as of Monday. He added that 57,834 out of the total were individuals aged 60 and above. ALSO READ: Covid-19: Health Ministry to prepare 3,000 courses of Paxlovid ahead of haj season “We encourage senior citizens and individuals with chronic conditions to get the second booster. To date, we have not received any reports on severe side effects following the second booster shot,” he told a media conference after launching the ministry’s Hospital Directors Conference at a hotel here. Covid-19 cases will fluctuate, and a potential new infection wave might emerge in the next few months, although the current situation is under control, said Khairy. “Perhaps we can expect a new wave within the next two and three months, but the magnitude is still unknown. “Based on epidemiological developments in other countries, a new wave could be ahead,” he added, encouraging high-risk individuals to be inoculated with the fourth Covid-19 vaccine shot. ALSO READ: Covid-19: Paxlovid antiviral to be free, enough supply to treat 48,000 patients Commenting on the rebooted immunisation programme for kids (PICKids), the minister said the decision was taken as the ministry found that there were children who had not received information on the previous immunisation programme. “As PICKids was announced to be ending for those children above five years old, the ministry realised that there are pockets of the population which had not received information on Covid-19 vaccines. “The ministry is now helping these groups get access to Covid-19 vaccination at its health clinics,” he added. Khairy said that 397 kids were inoculated on the first day of the five-day campaign, of whom 150 had just turned five.On Sunday, Deputy Health Minister Datuk Dr Noor Azmi Ghazali announced PICKids would reopen from Monday until Friday in conjunction with the 2022 National Immunisation Week.

Related stories:

Covid-19: Over 1,300 patients recovered after Paxlovid treatment, says KJ

Covid-19: Paxlovid to be available at private hospitals, clinics, teaching hospitals, says KJ

3,000 courses of Paxlovid in preparation to treat pilgrims

Covid-19: Health Ministry to prepare 3,000 courses of Paxlovid ahead of haj season

Paxlovid to be available soon in private hospitals, says ...

Health Ministry detects babies, children dropping out of immunisation...

Paxlovid now available in private health facilities - FMT

Paxlovid Now Available For Free In Private Hospitals

Pfizer's Covid-19 pill, Paxlovid. Picture from Pfizer.

3 ways to get COVID pills, if you've just tested positive - NPR

13 Things To Know About Paxlovid, the Latest COVID-19 Pil

Covid-19: Paxlovid antiviral to be free, enough supply to treat ...

Pfizer scams the world with US$22 billion in sales of Paxlovid to treat Covid.*

*Now finds that Paxlovid does not work and may cause rebound of disease*

Pfizer’s Covid Pill Doesn’t Work For Healthier Patients, Will Focus on Those With Higher Risk

Sunday 19 June 2022

China Launches High-Tech Aircraft Carrier Fujian in Naval Milestone; Buy Huawei P40 5G and Forget Apple 12.

China Launches High-Tech Aircraft Carrier in Naval Milestone

The StarGovt launches new aircraft carrier

The StarGovt launches new aircraft carrier

Fujian, 3rd Chinese Aircraft Carrier, Is Here!

Zanirun Baba - Buy Huawei P40 5G and Forget Apple 12..

How to Unlock Huawei P40, P40 Pro, P40 Lite

Thursday 16 June 2022

Remain vigilant against financial fraud

Cases of bank accounts looted by dodgy apps on the rise ...

THE Association of Banks in Malaysia (ABM) would like to remind members of the public to remain vigilant at all times to safeguard personal information. This includes avoiding downloading files or applications from unverified sources onto mobile devices. ABM would like to draw the public’s attention to the safety measures recommended by the Malaysia Computer Security Response Team’s (MyCERT) security advisory, published recently. Here are some of the safeguards recommended by MyCERT: > Do not install any app or Android package kit (.apk) file from unknown sources. This is because it may be malware designed to steal your personal details and your online banking credentials. > Do not click on adware or suspicious URLs sent through messaging services. > Do not root or jailbreak your device. > Verify an application’s permission settings and the application’s author or publisher before installing it. > Only download apps from official sources. > Do install antivirus software on your devices and run it regularly. > Update your device’s operating system and apps regularly. With cybercriminals and online fraudsters constantly changing their methods, ABM would also like to urge the public to remember the following: > Never divulge your personal details and/or banking credentials to unknown or unverified parties. > Never disclose your transaction authorisation code (TAC) or personal identification number (PIN) or your online login username and password to anyone. > Never click on any links to banks’ websites that are sent from unknown, suspicious or unverified emails. Always key in your bank’s website address directly into the URL bar in your Internet browser or use your bank’s official mobile app. > Avoid websites offering products at prices that are too good to be true and are littered with spelling mistakes – these tend to be fraudulent sites. > Avoid using public or open WiFi networks for online banking. > Always ensure that the banking website or banking app that you are using is genuine and official. > Always refer to your bank’s official website or contact your bank’s hotlines (stated on the back of your credit card or on the banks’ websites) directly for information, verification and clarification when in doubt. Bank account holders are also advised to monitor your statements as well as transaction alerts from the banks closely. If you notice any unusual or suspicious transactions, contact your bank as soon as possible to report it. Next, lodge a report with the police. Thereafter, notify the bank in writing with a copy of the police report and all relevant records and documentation, such as transaction history, etc. Due investigation processes are in place to determine if the reported transaction is indeed unauthorised. ABM would like to reiterate that member banks are required to adopt high standards of security, including for Internet and mobile banking services. Routine security reviews and advisories are also issued by Bank Negara Malaysia to financial institutions to ensure adequate protection against the latest threats. The public are advised to keep informed of emerging threats through the advisories issued by financial institutions, Bank Negara Malaysia and other authorities to protect themselves. Information on the latest threats and measures that you can take to protect yourself against cybercriminals and online fraudsters can be obtained from abm.org.my/consumer-information/fraud-alerts.ASSOCIATION OF BANKS IN MALAYSIA

Related stories:

BNM steps up collaboration with banks and law enforcement ...

Public getting fed up with never ending data leaks

Your personal data on sale – cheap | The Star

Related posts:

Saturday 11 June 2022

SOURCE: Data protection dept not doing its job

Personal Data Protection Department (PDPD) https://www.pdp.gov.my/jpdpv2/?lang=en

Jabatan Perlindungan Data Peribadi

Data Protection Dept Not Doing Its Job - Portal JPN

In mid-May, a data leak was reported by local tech portal Amanz, where a 160GB-sized database with personal details of 22 million Malaysians belonging to the National Registration Department (NRD) was being sold for US$10,000 (RM43,950) on the dark web.

Related posts:

Act swiftly to prevent data breaches

Take precautions on public wifi, hackers are watching you, travellers !

Be a smart tourist