“The US may settle into the malaise it found

itself in, during the 1970s, before the present wave of globalization.

It may survive but not thrive,’’ said Pong Teng Siew(pic) head of

research, Inter-Pacific Securities.

The initial impact is seen in emerging economies, where a fresh slowdown in the world economy has been concentrated.

Asian economies, in particular, will feel the pressure from slowing Chinese demand for their exports.

Commodity producing countries will also suffer as prices decline in the wake of sluggish demand from China.

In 2016 and 2017, China’s share of world demand came to 59% of cement, 56% of nickel, 50% each of coal, copper and steel, aluminium (47%), cotton (33%), rice (31%), gold (27%), corn (23%) and oil (14%), said Visual Capitalist that publishes data using visual methods.

While the IMF, in its half-yearly World Economic Outlook, had upgraded its forecast of US growth this year from 2.3% to 2.6%, it had downgraded China from 6.3% to 6.2%.

Growth expectations for emerging and developing economies is now cut, since April, by 0.3 percentage points to 4.1% this year.

China’s economy grew at an annual pace of 6.2% in the second quarter, the weakest in nearly three decades, while exports rose by just 0.1% in the first half.

Throughout the closely linked supply chains, these weak exports which registered the biggest drop to the US, also dampened demand for imports of components used in finished products.

Increasingly vulnerable to any slowdown in China, dubbed the Asian powerhouse, is the Association of Southeast Asian Nations (Asean) economic bloc, for which China was the biggest trading partner.

Trade between Asean and China hit US$587.87bil last year.

As there are expectations for Chinese growth to slide between 5% to 6%, the rest of Asia which have prioritized trade with China, may have to look elsewhere for growth.

Making matters worse, there will be no more super stimulus programme such as the US$586bil unleased after the 2008 financial crisis, which had a positive impact across the export-oriented region.

“There are, therefore, concerted efforts to try and resolve the US-China trade war,’’ said Nor Zahidi Alias, associate director of research, Malaysian Rating Corp.

But Asean is already a recipient of trade investment diversions from China, and it is likely that Asian countries will ramp up efforts, including improvement in infrastructure and the ease of doing business, to attract foreign direct investments from the United States and China.

In the short term, China, being a large trading nation, may have more to lose but it is already transitioning away from being dependent on trade.

Consumption had contributed to more than 60% growth in China during 11 out of 16 quarters from January 2015 to December 2018, said CNBC, quoting a July report by McKinsey.

Indicating its increased self-reliance, China had exported only 9% of its output in 2017, compared with 17% in 2007, the study found.

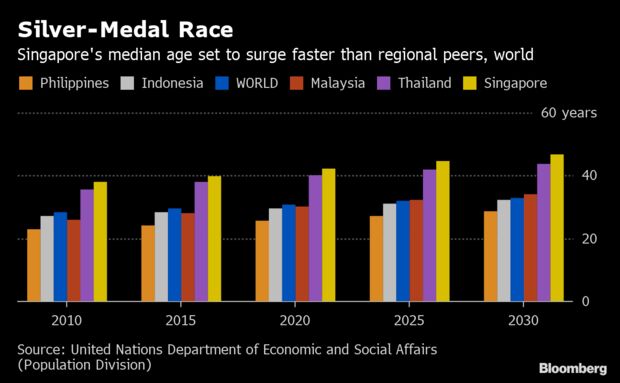

The three groups with most exposure to China are the Asian economies within the global supply chain (South Korea, Singapore, Malaysia, the Philippines and Vietnam); the resource rich countries that export to China (Australia, Chile, Costa Rica, Ghana and South Africa); and emerging markets with investments from China (Egypt and Pakistan).

The trade war has complicated China’s efforts to find a balance between sustaining decent growth and tackling problems of high corporate debt and massive shadow banking risks.

As a result, these ‘highly dependent’ countries will probably have to suffer more.

In the end, nobody gains especially those that want to ‘hide’ behind tariff walls, de-globalise and move away from the current global interdependence and integration.

The effects of de-globalisation can be serious.

Think of a 1970s type of scenario, said to be the worst decade for the US economy which, since the Great Depression, had experienced the worst downturn from November 1973 to March 1975.

“The US may settle into the malaise it found itself in, during the 1970s, before the present wave of globalization. It may survive but not thrive,’’ said Pong Teng Siew head of research, Inter-Pacific Securities.

The current wave of globalization is said to feature modern technology and global democratic processes, with increased movement of capital and adoption of free trade.

Consumers will be the ultimate loser; they have to face a decade or more of higher prices (on US and retaliatory tariffs) with little or no compensating increases in employment and income.

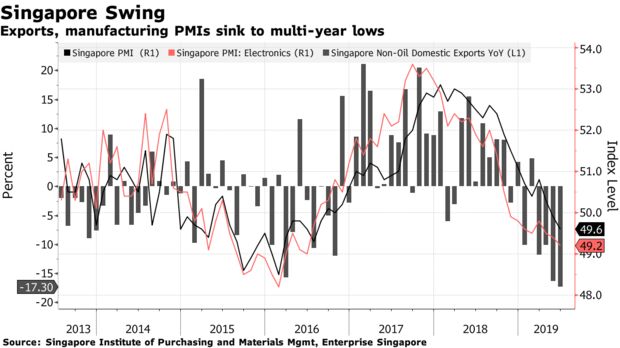

The huge job cuts happening around the world, with talk nearer home of layoffs and headcount freezes in the Singapore semiconductor industry, should give us an indication of some potentially alarming consumer downtrends.

By Columnist Yap Leng Kuen, who reckons nobody should be under the illusion that he is the winner. The views expressed here are solely that of the writer.

Source link

Read more:

Related posts:

Not much help: Despite his use of tariffs

to help skew the playing field in favour of US firms, the very

industries Trump has tried to h...