Market spurred by latent demand post pandemic

“Residential property transaction volume and values are up year-on year in 1H22.” Datuk Siders Sittampalam >>

“Residential property transaction volume and values are up year-on year in 1H22.” Datuk Siders Sittampalam >>

SINCE the resumption of economic activities and reopening of

international borders, the residential property market has seen a

pick-up in activity.

According to the National Property Information Centre (Napic), the

residential property sector recorded 116,178 transactions worth

Rm45.62bil in the first half of 2022 (1H22), which was an increase of

26.3% in volume and 32.2% in value year-on-year.

However, in light of prevailing uncertainties such as the upcoming

Budget 2023, potential 15th General Election and macroeconomic

headwinds, can the steady trend so far be sustained for the remainder of

2022?

PPC International managing director Datuk Siders Sittampalam says it’s

“anyone’s guess” how the local residential property market will fare for

the remainder of this year.

“With plenty going on such as the looming elections and global economic

uncertainty, it could have an indirect effect on the property market,”

he tells Starbizweek.

Still, Siders says the residential sub-sector has been off to a good start this year.

“Residential property transaction volume and values are up year-onyear in 1H22 and it’s been the highest increase since 2016.

“This can be attributed to latent demand, post pandemic. Many that held

back purchases in the market are now back again (since January 2022),”

he says.

Siders adds that loan approvals have also picked up, adding however that approval rates are still below pre-pandemic levels.

He also points out that the increase in interest rates so far this year

has not had an impact on the market (in terms of demand).

“Going forward, I believe that volume and values should sustain, just

like how they were in the first half of this year. It will be steady,

barring unforeseen factors, be it domestically or externally.”

According to Napic, the property market performance recorded a rebound

in 1H22, a reflection of normalising economic activity as the country

moved towards endemicity.

“With the positive projection on economic growth by Bank Negara (at

between 5.3% and 6.3% in 2022), supported by the implementation of

various government initiatives and assistance, the property market

performance is expected to be on track.”

Meanwhile, CBRE|WTW in its property market performance for 1H22,

believes that moving forward, transactional activities should remain

resilient in locations with good accessibility and comprehensive

amenities.

“Developers are anticipated to remain prudent, focusing on established

townships and mature locations. In addition, upcoming launches would see

a shift towards more sustainable elements to meet buyers’ shift for

cost-efficient and eco-friendly homes.”

As at the first quarter of 2022, CBRE|WTW says the Klang Valley landed residential sector remained encouraging.

“Average transacted prices rose 6.8% year-on-year while transacted

volume increased 11.2% year-onyear (more than 9,100 units), but was less

than the 10,000 units transacted in the fourth quarter of 2021.”

CBRE|WTW says new launches picked up slightly in the second quarter, despite developers maintaining a cautious approach.

“Landed launches continue to perform well and launch prices of terraced

houses remained between RM500,000 and RM800,000, except for some priced

above the Rm1mil mark in the City of Elmina, Setia Eco Templer and KL

East.”

Meanwhile, locations such as Klang Valley South, such as Sepang, Salak

Tinggi and Kuala Langat remain the hotspots, says CBRE|WTW.

It says these locations recorded consistent growth, encouraged by industrialisation and good road accessibility.

“Several areas located in the north of Klang Valley are also hotspots of

new launches, typically in Rawang, Puncak Alam and Sungai Buloh.”

As for high-rise residential units, Siders says a market study needs to be conducted to ease the oversupply of such properties.

“Comparatively, landed properties tend to do well as there’s always demand,” he says.

Siders also believes that the government could consider bringing back the Home Ownership Campaign (HOC) to spur the market.

To help drive the sector, the government introduced the HOC in June 2020 under the Penjana initiative.

The campaign ended on Dec 31, 2021. Many industry observers and property

players believed that the HOC was a huge help to the market and urged

the government to extend the campaign period into 2022.

Meanwhile, CBRE|WTW says additional measures are still required to

improve market activities for the high-rise residential sub-sector.

“The waiver of stamp duty should continue. A continual increase of the

overnight policy rate (OPR) is expected in 2H22 amid the global

high-cost environment.

“Since project launches have been limited, competition would also not

intensify, with prices remaining stagnant. The cost of borrowing may

further impact demand and prices if there is an additional OPR hike

2H22.”

CBRE|WTW adds that the upcoming launch of Mass Rapid Transit 3 may

benefit property valuers along the route, including an increase in

project launches, particularly in Mont Kiara.

“Moving forward, developers may shift focus to offerings emphasising exclusivity and low-density living with better facilities.”

CBRE|WTW says the existing supply of high-rise residential units stood

at 68,555 units in 1H22, whilst 219,398 units are in the pipeline for

completion by 2024.

“The bulk of incoming supply will be in central Kuala Lumpur, namely the golden triangle area (30%).”

On market activity, CBRE|WTW says both the average transacted value and

asking rents are stable at RM779 per sq ft and RM3.80 per sq ft,

respectively, supported by the increased interest from homebuyers and

renters.

“The average occupancy rate also increased slightly to 64% due to

improved market conditions. Following that, project launches have been

limited and the focus is still on the sales of ongoing projects.

“Nonetheless, two transit-oriented development projects were launched in

1H22 in Pudu and Bukit Damansara, with unit sizes ranging from 480 sq

ft to 1,080 sq ft priced from RM360,000 and units sized from 1,001 sq ft

priced from Rm1.8mil and above.”

According to Napic, Penang, Kuala Lumpur, Johor and Selangor formed about 47% of the total national residential volume in 1H22.

“More than 10,000 units of new launches were recorded, down by 66.7% against 31,687 units in 1H21.”

Against 2H21, the new launches were lower by 13.3% (2H21: 12,173 units),” it says.

“Sales performance for new launches stood at 20.3%, slightly lower than 1H21 (20.6%) and 2H21 (28.1%).”

According to Napic, Johor recorded the highest number of new launches in

the country, capturing nearly 23.8% (2,509 units) of the national total

with sales performance at 31.8%.

Sabah recorded the second highest number (1,335 units, 12.7% share) with

sales performance at 10.6%. This was followed by Perak (1,317 units,

12.5% share) with sales performance at 19.4%.

Terraced houses dominated the new launches. Single storey (2,047 units)

and two-to-three storey (5,150 units) together contributed 68.2% of the

total units with sales performance at 22%, followed by condominium /

apartment units at 19% share (2,009 units) with sales performance at

12.4%.

Positive 1H property market data trends

THE recently released property market data for the first half of 2022

(1H22) by the National Property Information Centre (Napic) showed that

the Malaysian property market has found a firmer footing over the review

period.

On a half-yearly basis, while transaction volume and value surged to a

new record high of 188,002 units worth Rm84.4bil, what was most

revealing is that the overhang market trend has finally eased, while

future and planned supply was reduced.

For the past four years, this column has been calling for stricter

measures to control the market’s oversupply situation and for property

developers to be more mindful of the market’s overhang status.

The data for the 1H22 shows that finally, some sanity has set in.

Having said that, as far as prices are concerned, the Malaysian House

Price Index (HPI), as seen in Figure 1, continues to show a declining

trend with the growth in the 1H22, slowing down to just 0.5%

year-on-year (y-o-y), dragged by a 2.5% y-o-y drop in Penang HPI, and in

terms of segment, detached homes and high-rises continue to dictate the

downtrend with a 2.3% and 0.5% y-o-y drop respectively.

An improved picture

For property overhang, this column aggregates the supply in the

residential segment and takes the data from both service apartments and

the Soho sub-segment to gauge the market’s overall residential overhang

status.

After all, it is the combination of the three that is the real market

supply in the residential market segment as shown in Figure 2.

In total, the residential overhang eased to 59,321 units valued at Rm42.59bil.

Although compared with a year ago, the number of overhang units and

value increased by 3.8% and 2.5% respectively, the overhang situation

for the residential segment improved as both the number of units and

value dropped by 6.5% and 4.4% respectively compared with six months

ago.

Nevertheless, the overhang situation within the high-rise segment (which

includes residential high rise, commercial service apartments, and Soho

units) remains elevated.

For the 1H22 period, Napic data showed that the overhang data is now at a

new record high of 45,502 units against 44,800 units as at end of 2021.

Only in terms of value, the 1H22 figure is relatively flat at Rm33.22bil against Rm33.32bil six months ago.

Overall, this translates to 76.7% of the overall market overhang in volume and almost 78% of the total value.

The overhang situation within the high-rise segment has indeed increased

as more than three out of four unsold properties are highrise units.

A steep drop

Figure 2 also shows the property market’s unsold units that are under construction.

From here, one would note that the 1H22 data showed a total of 108,826

units remained unsold valued at Rm60.95bil, down by 12.5% and 9.6%

compared with a year ago, and lower by 9.7% and 6.4% when measured

against the market’s position six months ago.

With the lower overhang and those under construction, overall, the

market saw total unsold properties down to 168,147 units worth some

Rm103.54bil.

Compared to a year ago, when the figure was 181,460 units worth

Rm108.93bil, the data for 1H22 saw a drop of 7.3% in volume and 4.9% in

value respectively.

When compared with the 183.918 units worth Rm109.69bil as at end of

2021, the 1H22 data showed a reduction of 6.4% in volume and 8.6% in

value respectively.

For the residential segment by state, the key overhang is located in

Kuala Lumpur and the states of Selangor, Johor, and Penang as they

account for 59% of total overhang units worth some Rm16.2bil, which

translates to 74.5% of the total overhang value in the residential

segment.

In terms of price points, properties marketed at above RM500,000 account for 43.4% of the market’s overhang.

For service apartments, Johor, Selangor, and Kuala Lumpur are key

geographical areas with the most overhang with a total of 96.8% of the

segment’s overhang in terms of units and 97.5% in terms of value.

Johor alone accounts for 68% of the segment’s total number of units and nearly 69% of the segment’s total value at Rm13.34bil.

Interestingly, in terms of the number of units, 89% of service apartment

overhang in Malaysia are priced at RM500,000 and above, valued at

Rm18.36bil, and they represent 95% of the total service apartment

overhang valued at Rm19.32bil.

As this column has repeatedly highlighted in the past that Malaysia has a

serious overhang issue, we are now finally seeing some light at the end

of the tunnel as the market has now seen a drop in future supply.

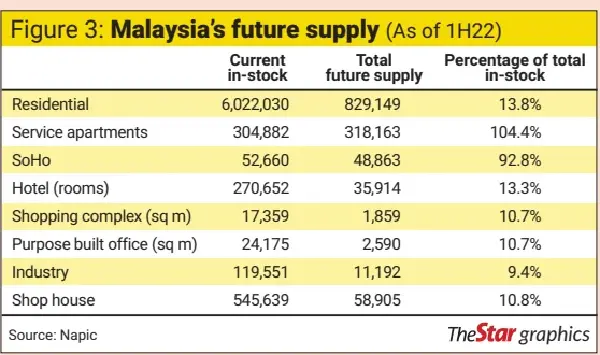

For easy reference, the data in Figure 3 for future supply includes

starts, incoming supply, planned supply, and planned new supply.

Overall, other than a 34% jump in purpose-built office space to 2.59

million sq m, all other segments are seeing a downtrend in future supply

with a reduction in the total number of units by between 8.1% for the

industrial segment to as much as 26.2% in future hotel room supplies.

The residential, service apartments and the Soho segment saw a reduction

of 16.3% in the total number of units to 1.196mil units from 1.430mil

units six months ago.

As a percentage of total in-stock, the future supply is lower by between

0.8 percentage points (pps) for the industrial segment to 21.1 pps for

the residential segment.

A word of caution though. Despite the reduction in future supplies, the

incoming supply for both the service apartment segment and Soho remains

significant at 104.4% and 92.8% respectively.

Despite the positives, the property market remains challenging as we are

still saddled with a high overhang as well as incoming supply. While

the positives are there based on the 1H22 data, it is not time to pop

the champagne just yet as it will still take a while (three to five

years) for a more positive trend to emerge.

Overall, the Malaysian property market is still up against a massive

over-supply situation and prices too are not expected to improve much,

as evident from the flattish growth or worse, negative, in the Malaysian

HPI.

Given the higher borrowing cost with an increase in the overnight policy rate, homebuyers are expected to remain cautious.

StarBiz PANKAJ U. KUMAR

StarBiz PANKAJ U. KUMAR

Related posts:

PETALING JAYA: House prices in Malaysia fell in the second quarter of 2022 (2Q22), marking the worst quarterly

contraction since the star

Is the Dollar the key to US hegemony?

Illustration:Chen Xia/Global Times The US Federal Reserve will hold a

new policy meeting on...

“Residential property transaction volume and values are up year-on year in 1H22.” Datuk Siders Sittampalam >>

“Residential property transaction volume and values are up year-on year in 1H22.” Datuk Siders Sittampalam >>

StarBiz PANKAJ U. KUMAR